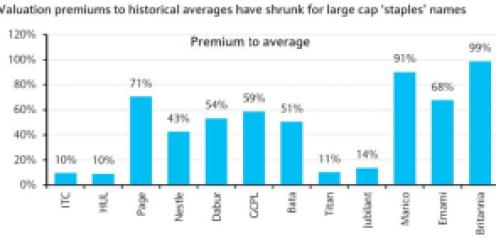

Markets are weird, i was going through Barclays report on India Consumer dt 21-Sep-15 and one chart caught my attention, even thought I had idea about the point I never got it to put it in black & white. here is the chart

most of the FMCG/consumer are trading at premium valuation compared to their respective historic averages. I would probably not pay too much attention to ITC, HUL, Titan and Jubliant as their premium is in range of 10%-14%.

While others like Britannia, Marico, Page Industries are trading at 99%, 91% & 71% to their historic valuation.

So I just thought to check performance of same stock post 21-Sep-15 and below is result

Barring Bata, Dabur & Marico every other stock has gone up. makes me wonder how long will premium valuation continue, will Mean reversion take place or as they say “This time it is Different”

Discover more from Random Thoughts of Analyst

Subscribe to get the latest posts sent to your email.