Miracle of Negative Revenue

This is guest post – idea has come in from very good Analyst friend – MV.

One of the best parts about Being Analyst is number of different kind of companies you and financial miracle you come across. I happened to call up very good Analyst friend who goes by the name MV to clarify one point about a company called “Career Point Ltd” (BSE code – 533260) and discuss led to discovering of miracle.

I will shortly come across big main miracle before that let me introduce to small miracle that I came across.

Career Point (CPIL) came up with IPO in Sept’10 with issue size of 115cr shares at price band Rs295-310 (CMP – 165, please be rest assured there was no bonus or split). CPIL was involved in providing tutorial service to high school and and post high school various competitive entrance exam (AIEE-JEE, medical & dental entrance, etc).

I still remember trying to understanding subscribe justification given by an Analyst belonging to retail broking firm. I said “valuations seem to factor in the best case scenario”, Analyst replied “its order from Sales guy”, I was like “couldn’t agree more”.

First Miracle

Anyway so here we are today and looking at Q3FY15 result of company and what do I see, company has expanded its scope of business from tutoring to automobile division. I vaguely remember talking to MV about it, so thought to call up and ask him about the same. MV clarified its actually not new thing, it’s been there for some time now, and they have started generating revenue hence it’s now visible. Career launcher has auto dealership of Hyundai cars.

BSE Link of Result – refer segment result on page-8

Capital Allocation and Circle of competency

For starters this is one of biggest thing that makes or breaks an company or an investor is “Capital Allocation. Everyone has limited capital and businessman/investor has to correctly allocate this capital in order to generate best return. However also remember, just because returns are good one should not go ahead and invest in it. One ought to remain in circle of competence. The Great Warren Buffett has said it many times he doesn’t invest in IT & Tech (barring his recent investment in IBM) as he doesn’t understand. Something similar seems to be happening here, not sure why a tutoring company is getting in auto dealership.

Second Miracle

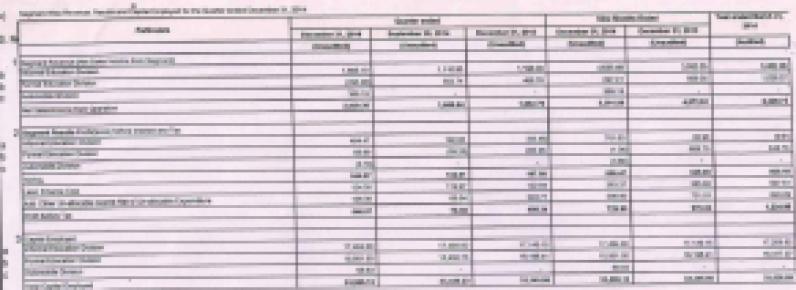

MV bought to my notice the real miracle, if you observe above segmental finance, one would notice a segment called “Formal Education Division” (just bear with me; don’t try to understand what it means). Now look at the revenue figure for the quarter negative 2.93cr (293.99 lakh). Now how does a company earn negative revenue…? If one were to total all segmental revenue and cross verify it with P&L Total revenue it comes to same number, so it’s not that somebody accidentally put a minus sign ahead of numbers.

This result was posted on 13-Feb-15 on BSE website, till now there has been no clarification so we wait. In mean time if anybody has clue on this negative revenue please do share.

Its changed now. On companies website it is like this

Informal education – 1588.89

Formal education – 72.22

Automobile Division – 369.19

Net Sales/Income from Operation – 2030.30

http://www.cpil.in/downloads/2014-15/FinancialResultsDec2014.pdf

Awesome article !!

Now even the numbers are corrected and says that net revenue for Formal education is 72.22 How can the profit be if 83.89 ??