Real Estate prices never fall

I had written this post in Oct’14 when SEBI passed judgment on DLF Ltd and its key promoter management barring them from accessing capital market. However I have modified key numbers /stock prices.

SEBI order / judgment – Link here , Media Coverage Link – 1, Link – 2, Link – 3

A rich businessman enters into business deal with a subsidiary of DLF (India’s largest real estate company, owns highest amount of land). Somewhere along the line DLF cheats him to the tune of Rs 34 cr. Businessman files case against DLF and battle goes to court.

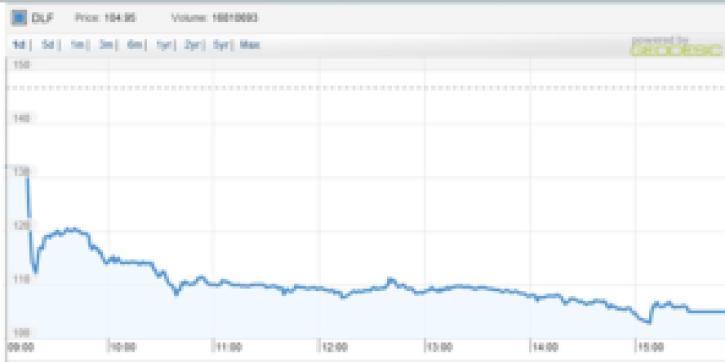

Everybody knows DLF, the biggest landowner of India. Everybody also knows real estate business in India is not for regular folks. Real estate is very much mafia business and black money flows like champagne. Hence most would have expected battle would be favour of DLF, but as would destiny would have in case of David vs Goliath, David won. The relatively small businessman won court case and impact; stock price dived by 30% …… (Last time I saw similar kind of drop in stock price was when Satyam was declared a scam company, obviously altogether a different case). Below is chart showing what 30% drop looks like…from Rs 132 to 105……..phew.

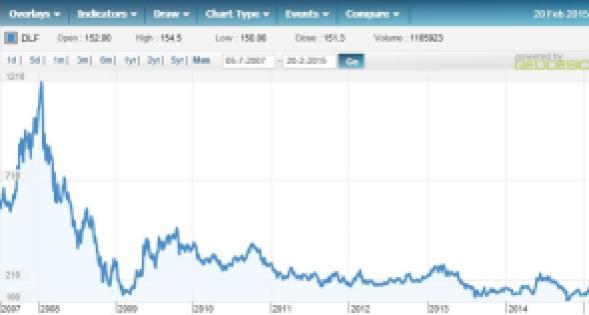

However this is nothing compared to IPO price. If you had bought DLF stock in IPO somewhere in 2007 for Rs525, at CMP of Rs 105 it would be wealth erosion of 80%.

Do you remember all those so called expert Analyst coming on Television/in-person telling you…”Real estate is great investment prices never fall…Its best investment”…. then why did stock price fall?……well my mother always said “son, if things are too good to be true, you are either in sleep & dreaming or you are dead”

Carl Gustav Jacob was a German mathematician, that most of us don’t know (you may know if you are related to his field). One of his biggest contribution to world was “Invert, always invert”. The great investor Warren Buffett has quoted that many times and probably you may feel you have heard that before. Charlie Munger , partner of Warren Buffett, often cited as Siamese twins (he is not) of Buffett said it as “tell me where I am going to die and I won’t go there”

Business of real estate involves selling a house/shop for a price. Most of investor who invested in real estate always believed that real estate prices would never fall. What one needs to invert here is not price part but demand part. Fundamental economic law states “all else being equal, as the price of a product increases, quantity demanded falls; likewise, as the price of a product decreases, quantity demanded increases”.

Below are the key Sales & PAT figures of few top real estate companies, watch trend you get idea. If maxim of real estate prices never falls hold true and demand for real estate never drop. Can all those smart people explain what went wrong with DLF’s PAT numbers from FY2010 to FY2014?

DLF that use to make profit of Rs1700cr in 2010 made Rs583cr in 2014, drop of 66%, in case of Oberoi its 32%, for HDIL its 68%. However Prestige, Godrej and Sobha seem to be growing.

| Rs cr | |||||

| Sales | 2014 | 2013 | 2012 | 2011 | 2010 |

| DLF | 8,298 | 7,773 | 9,629 | 9,561 | 7,459 |

| Prestige | 2,549 | 1,948 | 1,052 | 1,543 | 1,024 |

| Oberoi | 798 | 1,048 | 825 | 996 | 790 |

| Godrej | 1,179 | 1,037 | 770 | 447 | 241 |

| Sobha | 2,173 | 1,865 | 1,408 | 1,477 | 1,133 |

| HDIL | 872 | 1,025 | 2,006 | 1,850 | 1,502 |

| PAT | |||||

| DLF | 583 | 663 | 1,169 | 1,638 | 1,708 |

| Prestige | 324 | 294 | 88 | 167 | 129 |

| Oberoi | 311 | 505 | 463 | 517 | 458 |

| Godrej | 236 | 197 | 129 | 143 | 124 |

| Sobha | 234 | 217 | 210 | 185 | 138 |

| HDIL | 178 | 74 | 810 | 822 | 549 |

| source – moneycontrol.com | |||||