This post is not advice or recommendation to invest in company discussed, this is purely for educational and discussion purpose. So before you go and buy this stock, suggest you control your urge [if possible get rid of those urges ;)] and then read ahead with an open mind.

This is a guest post courtesy a good friend RUD, who is an excellent financial analyst and looks at small cap companies for personal investment. During one such hunt, he came across Panasonic Carbon. 63.27% owned by PANASONIC CORPORATION, the Japanese behemoth. Laxmi Devi Jiwarajka, Gopal Kumar Jiwarajka and JSK Marketing Private Limited are other promoters owning – 1.38%/0.02%/0.54% respectively. The company has a market cap of Rs219cr with no big domestic institutional investor (Which makes it perfect for undiscovered story). So RUD started looking at this company post Q3FY17 results and this is what he found.

The Company is into a business of manufacturing of Carbon Rods that is used in dry cell batteries. In FY16 66% of revenue was contributed by exports, balance 34% came in from Domestic.

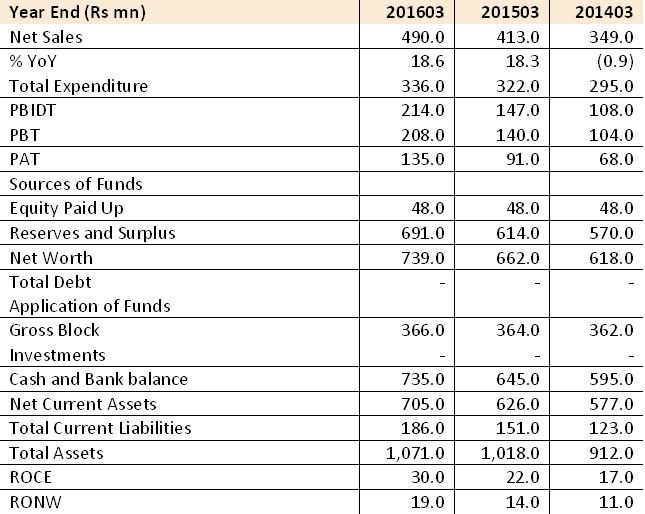

In FY16 company did revenue of Rs490mn with a PAT of 135mn, with zero debt on balance sheet. The company does healthy RoCE and RoE of 30% and 19%. However, if you closely observe balance sheet there is cash of Rs735mn, meaning your RoCE/RoE is way more than discussed earlier (adjusting for cash networth would stand at mere Rs4mn). Dividend payout stood at 36% in FY16 vs 42%/49%/52%/86% in FY15/FY14/FY13/FY12.

For 9mFY17 company had posted revenue of Rs380mn with PAT of Rs131mn there was exceptional income of Rs14mn on account of sale of land so adj for that PAT would be at Rs~120mn, meaning on annualised basis PAT of ~Rs160mn a healthy growth of 19%. While cash on books at end of 6mFY17 was Rs738mn. Business seemed decent and valuation at ~11x, with that plunge was taken.

Now comes Q4FY17 results

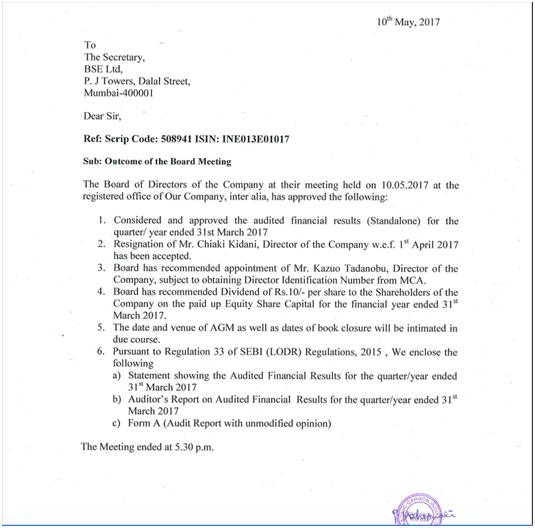

Here is the full copy of announcement –BSE Link here and in case that doesn’t work you can download it 4QFY17-Result-Copy-1. This was released on 10-May-17 and posted on BSE site post 6 pm.

Here is first page

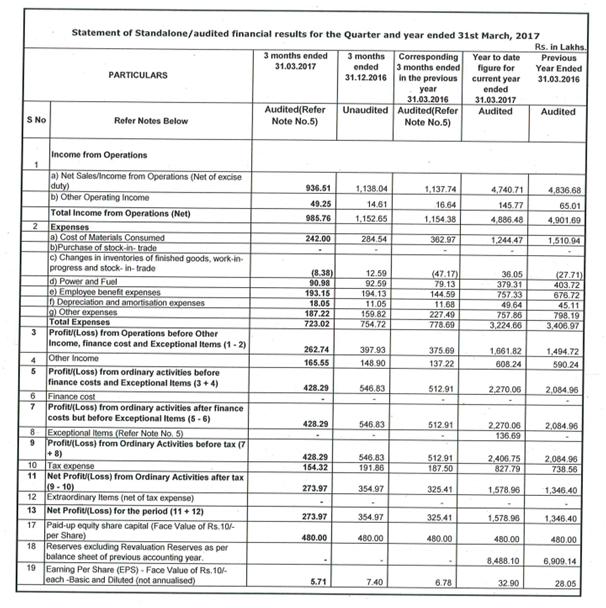

Here is second page that carries P&L

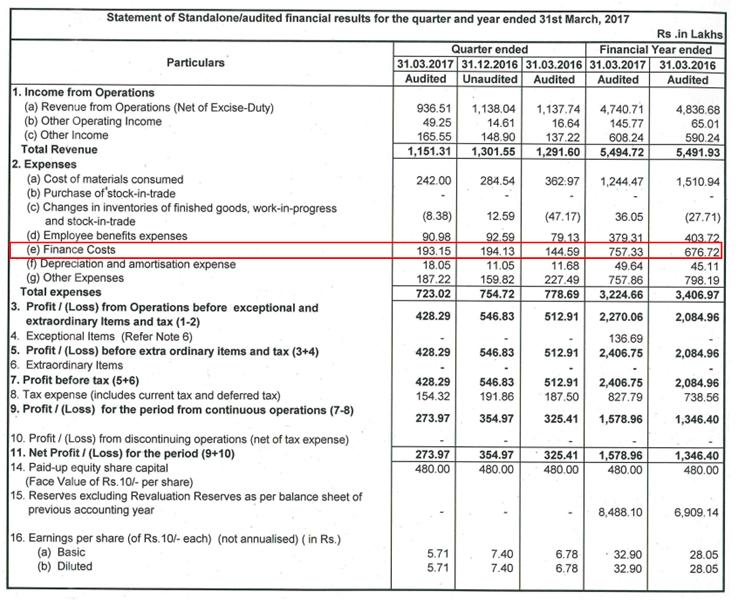

However suddenly after 1 week on 18-May-17 Company sent notice again to BSE along with new P&L – reinstated income statement. BSE link or 4QFY17-Result-Copy2

Here is P&L screenshot

On the face of it sales and PAT remains same as earlier one, but now there is financial cost to the tune of Rs75.7mn (for a company which is debt free), which in earlier statement was missing or was equivalent to staff cost, of course, Power & Fuel cost is missing in new statement which was there in earlier one. Just wondering if this is really a (costly) typo?

Another interesting announcement was done by the company on 9-May-17 (BSE Link or Board MD-9-May-17) with regards to board meeting conducted on 31-Jan-17. Company board had re-appointed Mr R Senthil Kumar, MD for a further period up to 31-Mar-18. Looks like somebody had a weak memory.

By the way, the company appointed (or rather promoted internal candidate) new CFO on 31-Jan-17 (BSE Link here or 31-Jan-17-New-CFO-Notice-BSE) and old company secretary resigned in Oct-16, so I assume the company has new company secretary also (BSE link here or 18-Oct-16-CS-resign-BSE).

any further views are welcome.

Discover more from Random Thoughts of Analyst

Subscribe to get the latest posts sent to your email.

1 Comment